2020 rental declines up to 15% forecasted

Demand for Grade A office space has declined 45% q-o-q in Asia Pacific, although it remains in positive territory, according to Cushman & Wakefield’s latest report Reclaim 2020: H2 Insights. Cost containment and capital preservation remain key strategies moving forward as regional net absorption continues to witness a decline.

“Although the region entered the pandemic in a relatively robust shape, COVID-19 has exposed pockets of weaknesses which emerged since the start of the year and accelerated the earlier predictions of a weakening of the office market,” said Mark Lampard, Head of Singapore Commercial Leasing and Regional Tenant Representation at Cushman & Wakefield. “We expected neutral markets to become more tenant friendly and landlord friendly markets moving to a more neutral, or even tenant friendly position, and this has unfolded more rapidly than expected. As at Q2 2020, just four markets, Bangkok, Ho Chi Minh City, Manila, and Taipei, in the Asia Pacific region remain landlord friendly, down from 11 at the start of the year and all four are reporting softening conditions.”

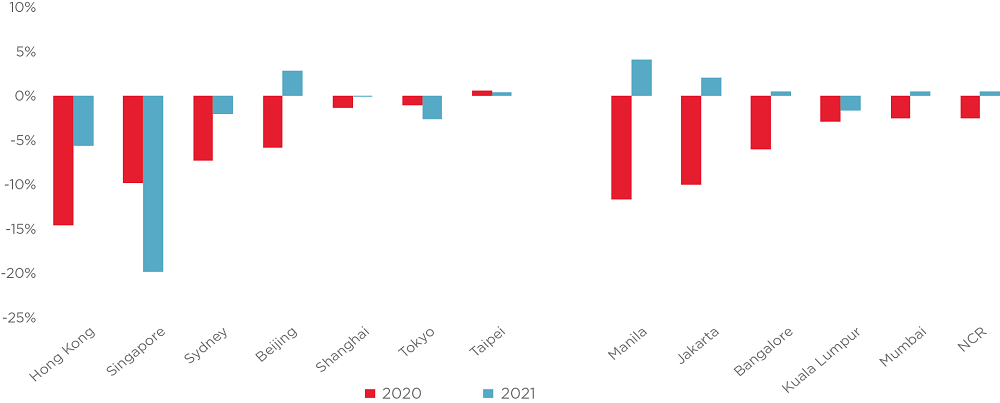

Widespread rental decline can be seen across the region in Q2. While there are green shoots of emerging economic recovery, sectors such as office, retail and hotel will lag this recovery and likely continue to soften over the next six months. Total rental declines for the year are expected to range up to 15% for markets that were already encountering headwinds prior to the pandemic. The vacancy outlook is much more nuanced, reflective of the wide range of conditions prevalent in each market, such as in Tokyo, as they entered the pandemic with a vacancy rate of less than 2%, while vacancy rates in other markets like Malaysia, Jakarta and many China markets were over 20%.

Grade A Office Annual Gross Effective Rent Growth Forecast

Source: Cushman & Wakefield Research

From a corporate occupier perspective, market uncertainty has led many non-business-critical decisions to be put on pause. New enquiries for space were down and regional net absorption has softened further from 10.1 million square feet in Q1 2020 to 6.9 million square feet in Q2 2020, which is 30% of the three-year rolling quarterly average.

Within this overall figure there are some brighter spots. Indian markets, specifically Hyderabad and Mumbai, recorded 3.7 million square feet of positive net absorption in Q2, albeit this was a 50% decline q-o-q and the softest result since 2013. On a brighter note, Tier 1 markets in China returned to positive net absorption after a particularly soft first quarter. While these may only be considered mildly positive, they stand in stark contrast against the almost 22.8 million square feet of negative net absorption recorded across US markets, further highlighting the resilience of the region so far.

Ryan Lee, Executive Director, Cushman & Wakefield Korea, said “In the Korean market, the market absorption rate has decreased by about 20% compared to the same period last year, and it is expected to maintain its continuous dominance as a tenant. The vacancy rate has remained unchanged for the second quarter compared to the first quarter, and is expected to show a similar trend in the second half. This is due to a large number of tenants canceling their transfers and reviewing their re-contracts, and some tenants and IT-based companies actively reviewing their transfers to reduce costs are expected to maintain a low rate of vacancy.”

“The impacts of COVID-19 have been swift and dramatic, with further downside risks likely to echo for some time yet. However, just as boom cycles come to an end, so too do bust cycles. There are green shoots of economic recovery already emerging across the region. The outlook for different markets will look different as it is tied very closely to their ability to keep the virus contained,” said Dr. Dominic Brown, Head of Insight & Analysis, Asia Pacific at Cushman & Wakefield. “The speed at which market changes occur will therefore vary, requiring a proactive and flexible approach from both occupiers and investors alike.”

Reclaim 2020: H2 Insights highlights the impact of the COVID-19 pandemic in Asia Pacific and the progress of recovery. The report discusses where green shoots of opportunity are emerging, and further insights to how investors, landlords and tenants should make real estate decisions in this environment. Click here to download the report.