Over recent years the healthcare sector in China has enjoyed favourable industry growth off the back of a growing economy, an ageing population and escalating healthcare spend.

Chinese population demographics in particular are moving in a favourable direction for healthcare companies. As people age, an increase in the level of individual healthcare is usually required. According to Eastspring China, by 2035, China’s aged population (aged 60 and above) is predicted to reach 409 million, representing a 28.5% share of the country’s total population.

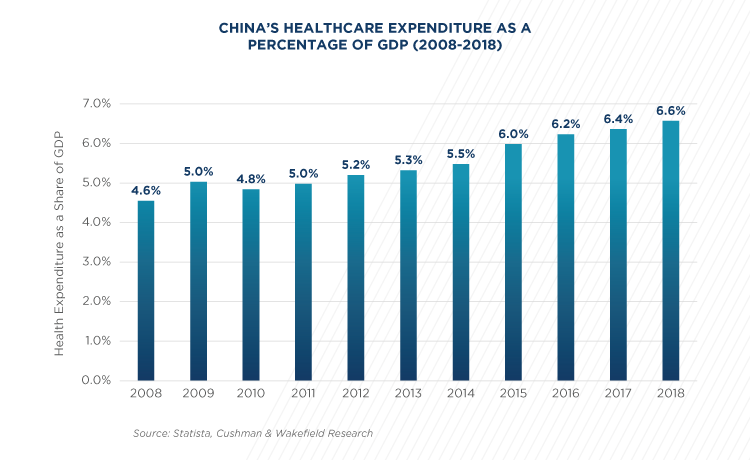

Along with China’s economic growth and ageing population, healthcare spending growth has also benefitted healthcare sector businesses in China. Healthcare spending in China as a percentage of GDP has been consecutively increasing on an annual basis since 2010. According to Statista, in 2018, healthcare expenditure equated to 6.57% of the country’s GDP.

Given the importance of the healthcare sector and the evident expanding market opportunities, healthcare companies have also steadily grown their organisations in China. Increasingly we’re seeing healthcare businesses looking to expand their commercial activity, evidenced when examining office leasing activity rates in city markets around China.

The COVID-19 Impact

During the COVID-19 outbreak in China, much experience from the SARS epidemic in 2003 was leveraged, with actions implemented at both the local and national level.

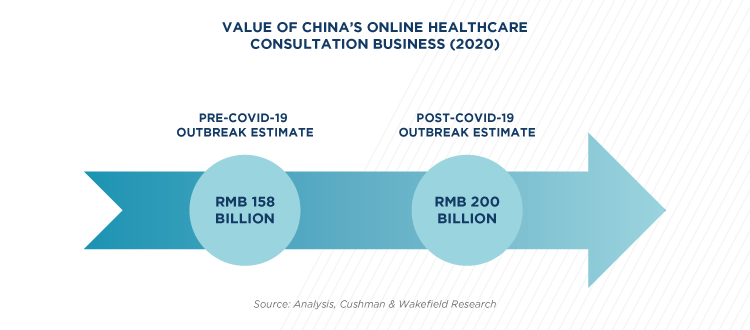

Technology also played a key role in containing the virus and in supporting personal health consultations. The public interest in online personal health consultation was so strong during the early part of this year that JD Health noted that online consultations rose ten-fold to 2 million.

Naturally, many healthcare companies in the pharmaceutical sector and the Traditional Chinese Medicine (TCM) sector also saw an increase in demand for anti-viral medicines during the outbreak period.

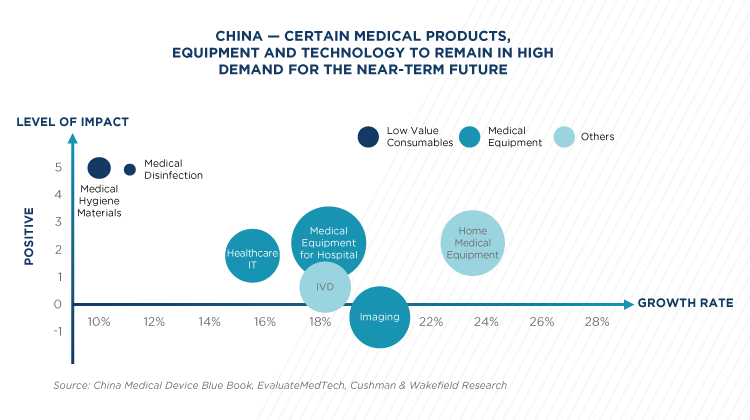

What’s more, companies associated with medical devices, such as ventilators, virus testing kits and protective equipment and clothing used to mitigate the virus also realised increased demand for their products during the outbreak period.

Additionally, other items that saw an increase in demand during the outbreak period in China were nutritional supplements to strengthen the immune system and Healthcare insurance policies.

What’s Next?

The COVID-19 outbreak has the potential to change China’s healthcare market, which according to McKinsey is expected to be worth US$ 2.3 trillion by 2030.

Moving forward, once the virus in China has been fully overcome, there is likely to be greater investment and spending channelled into disease prevention infrastructure in China. Other enhancements are likely to concentrate on improved patient-centric products, equipment, systems and processes, community healthcare, healthcare insurance and healthcare technology.

Finally, given the impact of COVID-19 and also the long-term healthcare sector-related macroeconomics in China, many new business opportunities are expected to emerge. Accordingly, Healthcare company executives and corporate real estate practitioners will have to rapidly reassess the situation and formulate new real estate portfolio stratagems to ensure their companies have a prescription for future business growth in China for the years to come.