• China’s capacity set to be increasingly allocated to domestic demand

• Network configuration, facility location and building specifications are key considerations for optimization of supply chains

• South East Asia and India set to be rising stars in supply chain networks

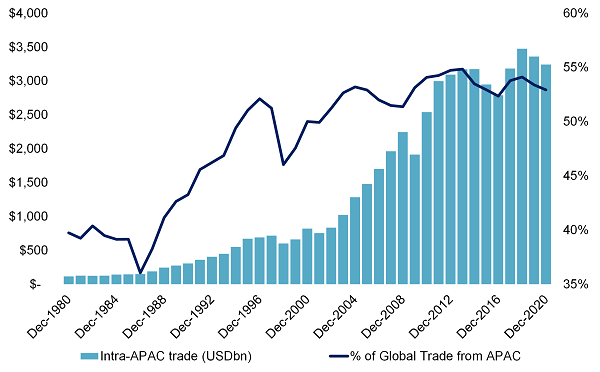

The COVID-19 pandemic over the last two years has put the spotlight on supply chain networks across the world, as supply disruptions became a major issue affecting the flow of trade globally and within regions. Asia’s role in global trade has also changed and with the growing importance in intraregional trade in Asia, corporations are having to reconfigure and build-out their logistics and industrial networks in the region, according to Cushman & Wakefield’s report, The Role of Asia Pacific in Global Supply Chains.

“As the world economies recover and businesses look for effective ways to address supply chain volatility, there is greater emphasis on being more resilient and designing flexible, responsive and efficient supply chain networks in the region to cater to regional needs. The rising ‘Asia for Asia’ approach sets the stage for the growth of supply chain networks in the region, particularly in South East Asia and India, and also highlights the critical factors that contribute towards the optimization of these networks,” said Tim Foster, Head of Supply Chain & Logistics Advisory, Asia Pacific at Cushman & Wakefield.

Cushman & Wakefield’s report, which looks at the impacts of disruption, customer buying behavior and the underlying megatrends on the design of supply chain and logistics networks, noted that Asian consumers are expected to buy more products originating from within the region and this trend is supported by the robust economic and demographic growth prospects for the region. By 2030, Asia is expected to account for over 40% of global economic output, 54% of the global population and a staggering 65% of the global middle class. The amount of trade taking place within Asia will therefore grow and have significant ramifications on the design of supply chain networks in the region.

Source: IMF, Moody’s, Cushman & Wakefield

While many businesses are still experiencing acute volatility in their supply chains due to COVID-related pressures, the situation is expected to ease somewhat towards the end of 2022. Given the predicted growth in the region over the next decade, the manufacture of technology-based products in Asia will grow, with South East Asia and India set to be the rising stars in the region’s supply chain networks.

“Asia will continue to be a key source of finished goods for global markets. The manufacture of components and sub-assemblies will increase in markets like Vietnam, Indonesia and India and these markets will move up the value chain and begin producing more finished goods. Food and beverage will drive growth in intraregional trade given their perishable nature and the need for cold chain integrity and traceability, with Indonesia, Vietnam, Philippines and Malaysia being key markets,” noted Mr. Foster.

Source: IMF, Moody’s, Cushman & Wakefield

“China is the leading example in the growing trend of consumers in Asia consuming more of the product made in Asia. Ahead, and into the next decade, we can expect that more and more of China’s supply chain capacity will go towards servicing domestic demand. Supply chain success for China will be dependent on adopting a customer-centric view, such as with the growth of e-commerce adoption. China’s online retail penetration rate is already the highest in the region by a considerable margin,” said Tony Su, Managing Director, Head of Industrial & Logistics Property Services, China at Cushman & Wakefield.

Designing and configuring supply chains to meet changing consumer demands, taking advantage of the megatrends around demographics, urbanization and technological advances, and factoring in structural shifts and disruption have a direct impact on demand for logistics and industrial real estate.

The growth of online retail has resulted in the rapid infill of last mile eCommerce networks, driving demand for space in sub-markets near major metropolitan areas that are well serviced by transportation networks. New development of real estate facilities must also adopt technology, automation and predictive analytics to plan and flow inventory from vendors to consumers to accelerate order fulfilment and space efficiency. Transparency and sustainability are also becoming increasingly important, with suppliers often required to provide information on their health, safety, labor and environmental practices, which then cascade downstream through the supply chain as corporations seek to meet their own Environmental, Social and Governance (ESG) targets.

Given the rising cost of industrial property and the fact that approximately 80% of the value and cost of a supply chain network is locked in at the design stage, Cushman & Wakefield identified three key real estate considerations to optimize supply chain across the region.

1. Network configuration – this will be dependent upon several factors, not least the footprint required for fast and efficient material and product flows as well as required storage capacity. Pressure on lean supply chains drives the need to consolidate the number of facilities to build scale while an agile network will be designed across a greater number of facilities.

2. Facility location – understanding lead times is a significant driver of location requirements and it is important to know how much inventory needs to be held in relation to the consumer compared to further back in the supply chain.

3. Building specifications – the pace of innovation has meant that specifications for prime-grade logistics buildings continue to advance. Building specifications should follow the needs of the customer, business requirements and facility processes, flows, layouts and automation.

Mr. Foster said, “Corporations need to focus on building resilience and flexibility into the supply chain. From a real estate perspective, the implications for industrial property abound but it is important to remember that real estate demand is the product of supply chain optimization. The key is to first design the optimal supply chain network, then execute on real estate requirements. Bringing these factors together in a coherent way provides the strongest approach to navigate short term and longer-term transformation.”

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms in the world, with approximately 50,000 employees in over 400 offices and 60 countries. In Greater China, a network of 22 offices serves local markets across the region, earning recognition and winning multiple awards for industry-leading performance. In 2021, the firm had revenue of $9.4 billion across core services including valuation, consulting, project & development services, capital markets, project & occupier services, industrial & logistics, retail and others. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.