European Outlook 2025

Transforming Challenges into Opportunities

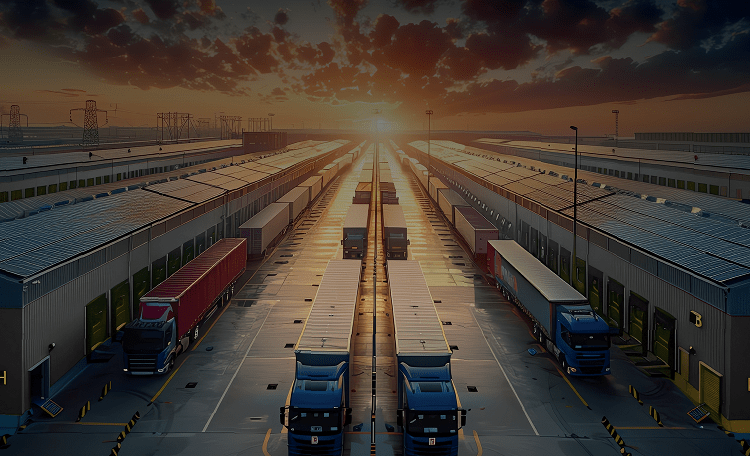

As we approach 2025, Europe’s commercial real estate (CRE) market is at a pivotal juncture. Recent years of economic uncertainties and shifting market dynamics have set the stage for transformation and growth. From stabilized economic conditions to evolving tenant demands, the opportunities are immense for those prepared to adapt and innovate.

Economic Landscape

Europe’s economy is showing clear signs of stabilization, with moderating inflation and potential interest rate cuts fostering an optimistic climate for investment. Easing monetary policies and rising consumer confidence create a favorable backdrop for growth across all CRE sectors.