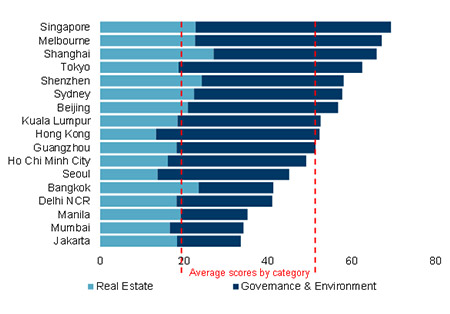

The Prepped Cities Index ranks state of preparedness of cities based on Built Environment and Governance & Environment factors

Singapore is Asia Pacific’s most prepared city in 2018, followed by Melbourne and Shanghai, according to ‘The Prepped Cities Index’, Cushman & Wakefield’s inaugural report that assesses the current state of preparedness of 17 major business centres in the Asia Pacific region according to a wide range of macroeconomic, structural, defensive and social indicators, including factors in the built environment.

The Prepped Cities Index looks at eight indicators across Built Environment (Cost/Rental Volatility, Obsolescence, and Sustainability) and Governance & Environment (Governance, Terrorism, Talent, Susceptibility and Cyber Security).

Dr. Dominic Brown, Head of Research, Asia Pacific at Cushman & Wakefield said, “This index uses a combined approach of assessing both Built Environment and Governance & Environment factors to help identify which cities are best prepared in deterring and managing a crisis against future uncertainty. Given that real estate is a pillar of the regional economy, coupled with the massive amounts of investment in the built environment, the real estate industry can directly play a role in making cities better prepared for the future.”

Key Highlights

- Singapore tops the list as the region’s most prepared city, having ranked in the top two places on three out of the eight indicators, namely Sustainability, Governance and Cyber Security, and in the top half for all other indicators except on affordability.

- Melbourne had a strong showing across the majority of categories (1st in Terrorism and Talent; 3rd in Sustainability). However, the city placed second overall due to a lack of new quality office supply to replenish ageing stock and a raft of political changes over the past decade.

- In third place, Shanghai (2nd in Terrorism and Talent; 3rd in Obsolescence) outshone all other cities in its real estate preparedness, boasting low cost volatility and a robust pipeline of new office supply. While the Chinese megacity showed no specific weaknesses in terms of governance and environmental factors, performance could be improved in the area of cyber security.

- Lower-ranked cities performed comparatively well across built environment factors, with a robust supply pipeline, young building age and an increasing proportion of Grade A stock. However, there are opportunities for improvement across metrics such as cyber security and development of emergency management plans, which is even more important given their high population densities and in some cases, a high susceptibility to natural disasters.

Chart: Preparedness Ranking for 17 major business centers in Asia Pacific (Source: Cushman & Wakefield Research)

“In the built environment, the cities that are best prepared to address unexpected events hold property assets that are modern, institutionally owned to a high degree, has a forward-looking approach to sustainability and less susceptible to pricing volatility. By understanding these characteristics, real estate players can better prioritize and direct their real estate strategies. Occupiers can adopt a proactive approach to devise and evaluate their corporate real estate portfolio strategy to account for factors such as preparedness. For investors and developers, the results of the index can help landlords to refine risk adjusted returns and identify suitable programs of capital expenditure as well as be ready to respond to occupiers’ preparedness requests and changing needs,” noted Dr. Brown.

To elevate the state of preparedness, Cushman & Wakefield recommends the following actions related to the real estate space:

- For markets where the average building age tends to be older, policymakers should seek to encourage owners to upgrade to meet current technical building standards. The asset manager should identify a sensible schedule of capital expenditure through a robust asset management plan that can lead to greater tenant attraction and retention as well as deepen the pool of prospective buyers of such an asset.

- Mitigate the impact of volatility through a deep understanding of local market drivers, robust forecasts and strategic insights to help develop a robust and longer-term leasing plan.

- A detailed assessment at the asset level, such as an energy audit can help identify where the most meaningful improvements on the sustainability rating can be made. From the occupier’s perspective, such enhancements may also improve working environments thereby supporting talent retention.

- Occupiers and investors who are active in cities with low cyber security preparedness should consider adopting company-level initiatives, such as implementing training sessions and strengthening IT systems. The asset management team should also develop an optimised security plan suited to the situation on the ground. Through initiatives such as centralization of security functions, situational awareness can be enhanced and when reinforced by clear emergency protocols, will support a rapid response.

- In markets where there is a high level of competition for talent, optimized working environments become critical. Introduction of the latest workplace strategies will aid in attracting and retaining the best talent.

For further information, please contact:

Chek Yee Foo

Head of Communications, APAC

+65 6317 8353

Chekyee.foo@cushwake.com

Tony Au

Senior Manager, Marketing and Communications, APAC

+65 6317 8326 / +65 8321 1327

Tony.au@cushwake.com

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries. In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushwakefield.com or follow @CushWake External Link on Twitter.