Investment

IIn the third quarter of the year, the investment market saw a significant recovery, reaching over 3 €Bn, which doubled the volume from the same period last year and brought the total for the first three quarters to 6.45 €Bn. Retail led with 45% of the quarterly volume, primarily driven by the Via Montenapoleone 8 acquisition, while the Industrial & Logistics sector followed, contributing 22% of the total. Foreign capital increased steadily, accounting for 78% of Q3 investments, raising its share to 64% over the first three quarters of the year.

Office

With 435 €Mn invested in Q3, the Office sector is gaining interest compared to last year's trend, reaching an year-to-date volume of 1.2 €Bn, which already surpasses the total investment volumes for all of 2023. Investment activity remains concentrated in the cities of Milan and Rome, which have accounted for 47% and 46% of the total volume year-to-date, respectively. The occupier market performed positively in both Milan, with 87,000 sqm absorbed, and Rome, with 56,000 sqm. In Rome, nearly 50% of the quarterly volume was driven by two major transactions. Sustainability has become a pivotal factor in occupiers' leasing decisions, but the market is constrained by a shortage of high-quality spaces.

Logistics

In the third quarter of the year, market absorption remained stable compared to the first two quarters, with 568,000 sqm, bringing the total volume since the beginning of the year to nearly 1.6Mn sqm, below the volume recorded in the same period last year. Companies are now prioritizing operational efficiency and aligning their strategies with sustainability objectives, which is driving growing interest in high-quality, energy-efficient properties. On the investment side, as pricing levels begin to stabilize, market activity is gradually recovering. In Q3 2024 transaction volumes, with approximately 655 €Mn, matched those recorded in the first half of the year and recorded a 45% increase compared to Q3 2023. This result was largely driven by a major portfolio transaction, which accounted for 51% of the quarterly total. The year-to-date (YTD) total reached 1.2 €Bn, representing a 17% rise from the same period in 2023.

Retail

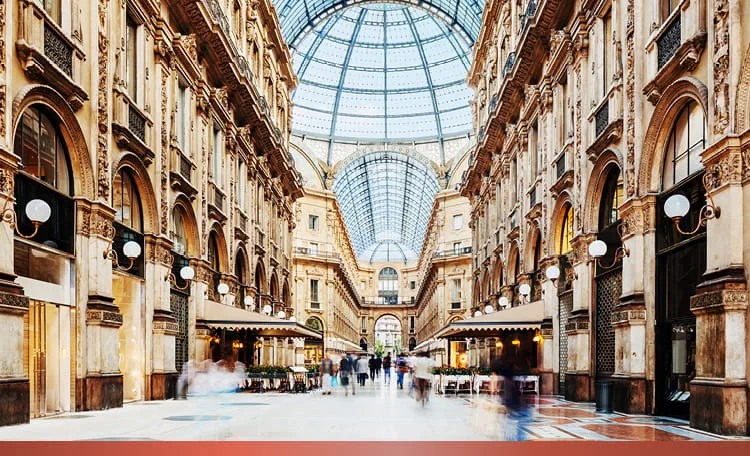

In the third quarter, the acquisition of Via Montenapoleone 8 for €1.3 billion significantly boosted both retail and overall investment volumes in Italy. Investors’ interest in retail is gradually returning, in the wake of the ECB rate revision.

Occupiers were active in both high streets and prime shopping centers, underscoring the strategic importance of physical stores in their expansion plans. The sportswear sector shone the brightest, followed by food and beverage (F&B) and leisure. Despite the sector’s current instability, luxury operators continued to focus on the most renowned shopping streets.

Hospitality

Second half of the year investment volumes bounced back and hit around 1 €Bn, nearly twice as much as the same time in the previous year and higher than the first half. The annual volume of about €1.5 bn was almost aligned to past year figure. The sector remains attractive due to its strong performance and prospects for 2024 are still positive. Yields increased in the second half to match the overall higher yield situation and the tight lending conditions. This pattern is expected to continue for lower-quality assets in the short term, while high-quality assets in the luxury sector are likely to stay steady. Outlook confirmed positive.