The impact of the COVID-19 pandemic and the disruptions to production and movement of goods across the globe have highlighted the importance of well-functioning, robust supply chains. Whilst the most significant impacts of the pandemic have somewhat subsided, the global economy and businesses alike are now faced with fresh and evolving challenges. The war in Ukraine has not only impacted the availability and cost of energy and commodities but has also heightened risk levels, especially economic and political risks, as the spectre of rising costs and constrained economic activity raise social and political tensions. Beyond this, climate change and natural disaster risks continue to challenge countries’ abilities to create and maintain stable and secure environments for business growth. Lastly, and not insignificantly, labour market dynamics – particularly the availability and cost of appropriate staff – remain a key consideration for businesses when locating and operating their facilities in different jurisdictions.

These, along with business-specific considerations, make choosing places for locating manufacturing and production facilities crucial for operational and strategic success. The Cushman & Wakefield Manufacturing Risk Index (MRI) brings together a range of important indicators to assess the relative attractiveness amongst 45 countries in EMEA, the Americas and Asia Pacific as locations of production and assist businesses in considering how their operations may be affected by current conditions.

Countries are assessed based on three key areas:

- Conditions: Business environment, including the availability of talent/labour and access to markets

- Costs: Operating costs including labour, electricity and real estate

- Risks: Political, economic and environmental

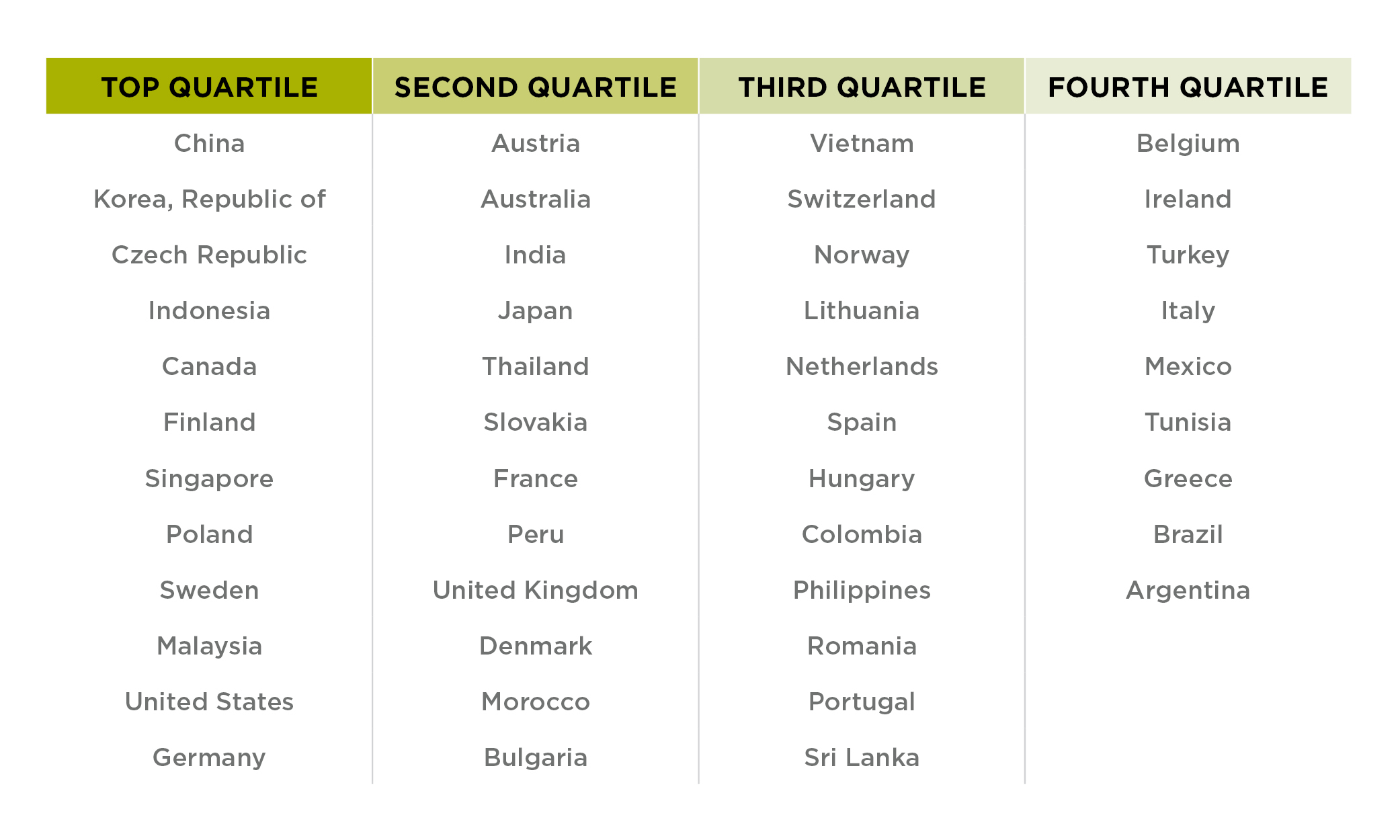

Baseline Scenario

China

China retains the top position in our Baseline scenario ranking. China continues to enjoy significantly lower costs of labour than other major production locations and, whilst wages have increased in recent years, are still amongst the lowest globally. As part of the market’s transition to higher-order manufacturing, industrial production in China has remained buoyed by newly-emerging industries such as “new energy” and “new material” products, including charging piles, wind turbines and photovoltaic cells and the production of “new energy” vehicles which has benefited from positive government support. This transition, together with ongoing economic expansion of the Asia Pacific region and the commensurate demand for goods, will continue to support China’s manufacturing sector.

India & Southeast Asia

India, Indonesia, Malaysia and Thailand also remain high in the MRI rankings with all enjoying plentiful, low-cost labour together with governments that are actively seeking to attract both domestic and foreign investment in manufacturing and production operations. They also benefit from geographic proximity to China, which facilitates “China+” diversification strategies, whereby additional manufacturing locations are established elsewhere in the region to complement production in China and help mitigate supply chain interruption risks.

Similar trends are also benefiting Vietnam, which has seen rapid expansion of its industrial sector over recent years. The market also benefits from geographical connectivity both within the region and to markets outside of the region. Indeed, as a result of burgeoning demand for new manufacturing facilities in Vietnam, major shipping lines such as MSC, Maersk and CMA CGM are investing in new capacity in the country to expand their operations.

United States & Canada

The United States and Canada have both fallen slightly but still remain high in the Baseline rankings. Unlike other countries, both have enjoyed a relatively stable cost environment but have seen an increase in risk elements, particularly exposure to natural disaster risk, as well as challenges to business conditions, particularly a drop in the unemployment rate and therefore access to available labour. Though also falling slightly on the risk side, Mexico has risen slightly on cost rankings. This is prompting Mexico to be considered an attractive option to help bring some manufacturers back to the Americas to help diversify supply chains. The attractiveness of a lower cost option becomes especially tempting to those in the United States and Canada by also complying with the United States-Mexico-Canada Agreement (USMCA) regulations around vehicle part production and steel purchasing. USMCA requires 75% of a vehicle’s parts to be made in one of the three countries for the vehicle to pass through the countries duty-free.

U.S. companies are also starting to bring jobs and supply chains home at a historic pace. American companies are on pace to reshore, or return to the U.S., nearly 350,000 jobs this year, according to a report published by the Reshoring Initiative. That would be the highest number on record since the group began tracking the data in 2010. It is a promising sign that manufacturers are looking to diversify supply chains and reduce risk.

Colombia & Peru

A few other markets in the Americas, most notably Colombia and Peru, have improved upon their Baseline rankings due to lower labour costs and relatively low cost of electricity. While Peru saw no significant change in risk, other countries around it deteriorated, improving its status on the risk rankings. Colombia remained flat in the third quartile on the risk. Both countries remain in the top quartile in terms of cost.

EMEA

In EMEA, Poland has assumed the position as the highest ranked country in the Baseline rankings, moving it slightly ahead of the Czech Republic which was the highest ranked EMEA location in 2021. Poland’s elevation is partly due to the lower costs of labour and electricity relative not only to Western and Northern European countries but also to some of its Eastern European neighbours such as Romania, Lithuania, Bulgaria and Czech Republic although all remain low in relative terms to other European countries. However, many countries in Europe have suffered from an increase in economic risk as the challenges around security of energy supply threaten to negatively impact economic prospects in the near term. This, along with higher electricity costs (notably as a result of challenges in supply and rising costs of natural gas due to the war in Ukraine) and labour costs (particularly as a lack of staff availability has pushed wages for workers higher) has meant countries such as France, Netherlands and Spain have suffered falls in their rankings this year. How swiftly these elevated cost and heightened risk challenges will be resolved will make a significant difference to the competitiveness of many European countries as production locations in the near term.

However, considerations about locational choice for manufacturing operations are becoming somewhat more nuanced than just a cost-of-production story. Length, security and resiliency of supply chains are now playing an increasingly important role in decision-making for manufacturers; the challenges of supply chain disruption and the risk of business interruption are fuelling companies to consider nearshoring production to locations more proximate to markets of consumption. And whilst cost remains important to overall considerations, businesses are shifting their perspectives around what constitutes key determinants of risk and security. As a result, European and Mediterranean locations that can demonstrate strong credentials on cost, but are also closer to end-destination markets, and especially where they can offer access to appropriately skilled labour and reliability of energy supply, will continue to enjoy opportunities to capture demand for production facilities either as primary sites or as complimentary sites to those in further-away locations.

Cost Scenario

On a cost-weighted basis, the top manufacturing locations are overwhelmingly located in Asia: of the twelve locations in the top quartile of the MRI, eight are in Asia. The top seven countries all remain at the top of the rankings albeit with small movements compared with 2021; all have enjoyed broadly stable or even slightly lower costs (in USD terms) for the key elements of labour and electricity. China, Indonesia and India all continue to benefit not only from a plentiful supply of low-cost labour but also lower costs in electricity and real estate construction.

Outside Asia, Latin and South American locations also rank highly, particularly as a result of some of the lowest labour costs outside Asia. Colombia retains its eighth ranked position but Peru and Mexico both have been elevated in the rankings to 10th and 15th (up from 11th and 17th), largely as a result of stable or slightly reduced costs in these countries relative to others.

In Europe and the Mediterranean, Turkey and Poland have also both improved in their rankings this year, as have Morocco and Tunisia. All have enjoyed broadly stable or even slightly lower labour costs in USD terms (particularly as some domestic currencies have continued to fall against the dollar) along with relatively low electricity costs for Turkey, Morocco and Tunisia. Whilst energy costs have risen in Poland, the rates are still lower than in other nearby lower-cost locations such as Lithuania, Romania, Bulgaria and the Czech Republic. Energy costs will remain a key issue for European markets which are more exposed to higher price levels and heightened volatility due to the challenges around securing fuels, particularly natural gas, as a result of the war in Ukraine and the resulting limitations to supply. However, there may well be opportunities for longer term energy security as many countries seek to move their energy reliance away from fossil fuels and towards reliable and sustainable energy sources including renewable, nuclear and alternative fuels.

Risk Scenario

When considering risk as a key location factor, China continues to top the rankings, in part due to such high scores in the business conditions and cost factors but also due to improvements in corporate and economic risk conditions. In recent years, reforms designed to relax the regulatory conditions for foreign investment in China have been implemented, signalling the country’s determination to create attractive conditions for more overseas investment.

Other APAC countries such as Malaysia and Indonesia have enjoyed a significant boost to their rankings this year due to improvements in corporate risk factors and capabilities in achieving sustainability targets, an important consideration for businesses investing in energy and resource-demanding production and distribution.

The United States and Canada have both seen their rankings on a risk basis fall due to heightened levels of economic risk as well as natural disaster risk; exposure to factors such as drought, flooding, wildfires and other extreme weather events are now at higher levels than previously but are somewhat mitigated by these highly adaptive and resilient countries’ capabilities of coping and adapting to these risks.

Countries in Europe typically enjoy some of the world’s lowest geopolitical risk profiles but many are currently facing heightened risk levels, particularly economic and political, as the challenges of the regional and global dynamics impact individual countries. For some, including Czech Republic and Poland, improvements to the countries’ capabilities achieving sustainability targets, along with highly competitive cost profiles, have helped to bolster their position in the rankings, despite elements of heightened economic risk. For others, such as Finland, Sweden, Germany and Austria, their strong credentials as stable, transparent countries have meant that despite some degree of elevated economic risk in particular, they remain amongst the highest-ranking countries globally. For others, such as Denmark and the Netherlands, raised economic risk levels coupled with higher costs and more challenging labour-market conditions have meant that their rankings this year have slipped but as with many European countries, improvements to the economic and political risk conditions will likely return them to their positions further up the rankings.

INTERACTIVE MAP

Please note that this mapping experience is best viewed on a laptop or desktop.

MRI Methodology

The Manufacturing Risk Index (MRI) assesses the most suitable locations for global manufacturing among 45 countries in EMEA, the Americas and Asia-Pacific. Each country is scored against 20 tier-2/3 variables that make up the tier-1 variables (conditions, cost and risk), whose weightings vary in the three scenarios presented in this report. The data underpinning the MRI comes from a variety of reliable sources, including the World Economic Forum, Moody’s Analytics and World Bank. A list of the tier-2 variables is available below.

The broad nature of the manufacturing sector means that the importance of these key parameters will inevitably vary on an individual basis. The results contained within our ranking do not provide a definitive answer for all manufacturing companies on where their facilities should be located. They are instead intended to act as a guide as to how locations can be ranked using a given set of parameters and weightings.

For more information

Cushman & Wakefield’s logistics and industrial professionals provide local market expertise around the globe. Our comprehensive menu of integrated real estate and facility services combines worldwide reach, coordinated local execution, and advanced data analytics to deliver the highest value service in the industry. For a more in-depth overview of the index rankings or to discuss your real estate strategy, please contact: