Discover investment trends, market dynamics, and sustainability practices shaping real estate and hospitality investments

Cushman & Wakefield's Hotel Investor Compass survey canvasses the views of 60 major investors active across the region, who collectively invested €18 billion between 2019 and 2023 in hotels and have an average fund size of €233 million available for hotel investment in 2024.

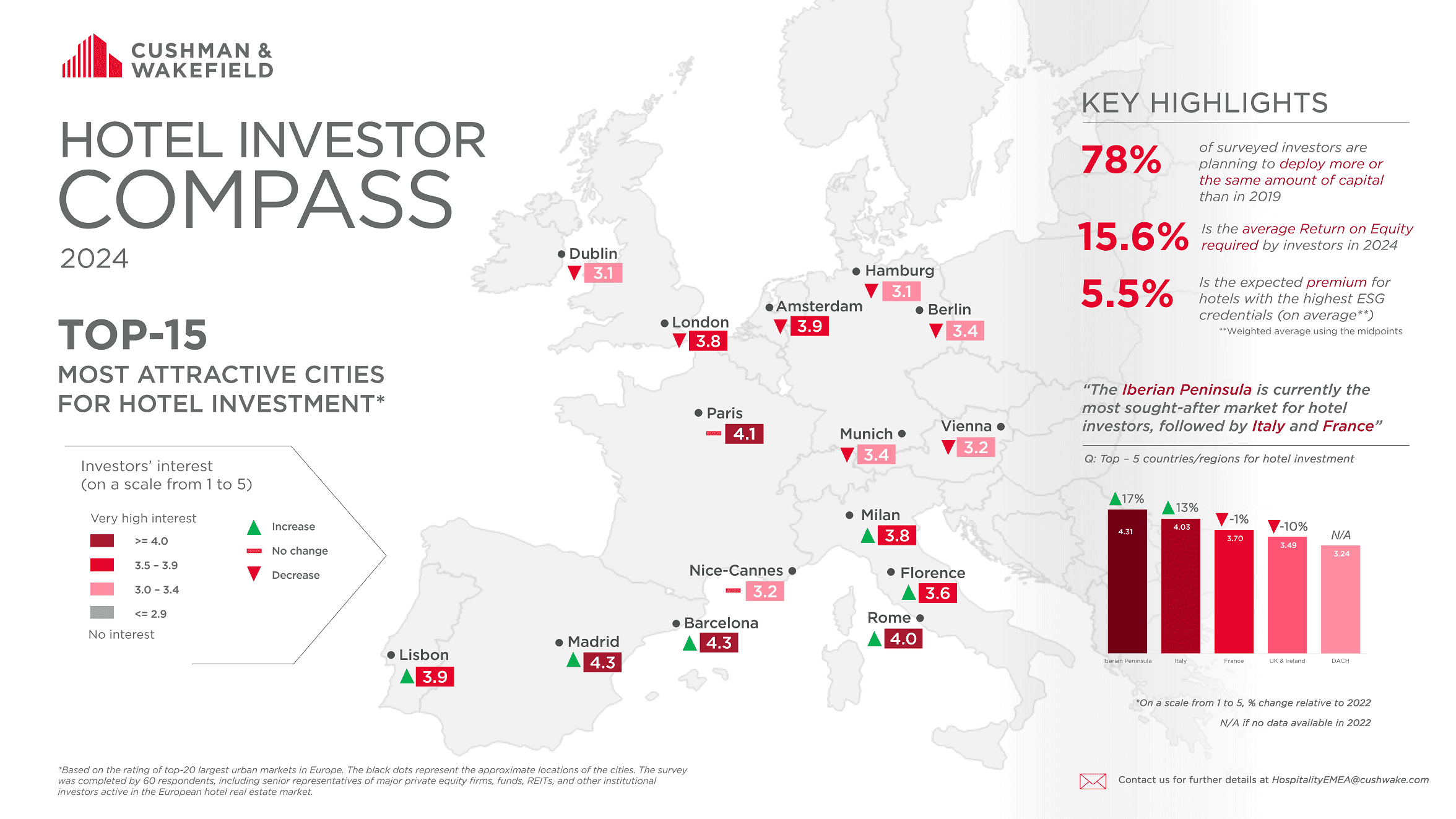

The research shows investor demand heavily pivoting towards southern European markets, with the Iberian Peninsula and Italy garnering the highest investment interest scores. Spain and Portugal’s increased interest is particularly significant, seeing a 17% uptick from 2022.

Madrid and Barcelona top the list of cities where investment interest is strongest, followed by Paris and Rome. Contributing to this, Barcelona saw the biggest increase in attractiveness relative to 2022 (+10%), while Lisbon saw an 8% increase and Madrid a 7% rise.

A substantial 78% of the investors surveyed intend to deploy the same or more capital into European hotels this year compared to pre-pandemic 2019 levels. Value-add opportunities are being aggressively targeted, with 92% of respondents focused on this strategy of acquiring assets requiring repositioning or moderate capital expenditure. Nearly half of investors are planning to be net buyers in 2024.

Findings of the survey also point to the premium investors expecting to pay for hotels with superior ESG credentials. On average, respondents indicated they expect to pay a 5.5% premium versus non-certified properties for those achieving the highest level of ESG certification such as BREEAM Outstanding or LEED Platinum ratings.

There is a strong pull towards investment in upscale hotel segments, including luxury and upper-upscale, which are seeing the biggest increases in investor demand versus 2019, 53% and 46% respectively.

When asked about the level of attractiveness of accommodation types, investors indicated that the most attractive were resorts (74%) and serviced apartment (59%) properties.