Rethinking European Offices

18/12/2024

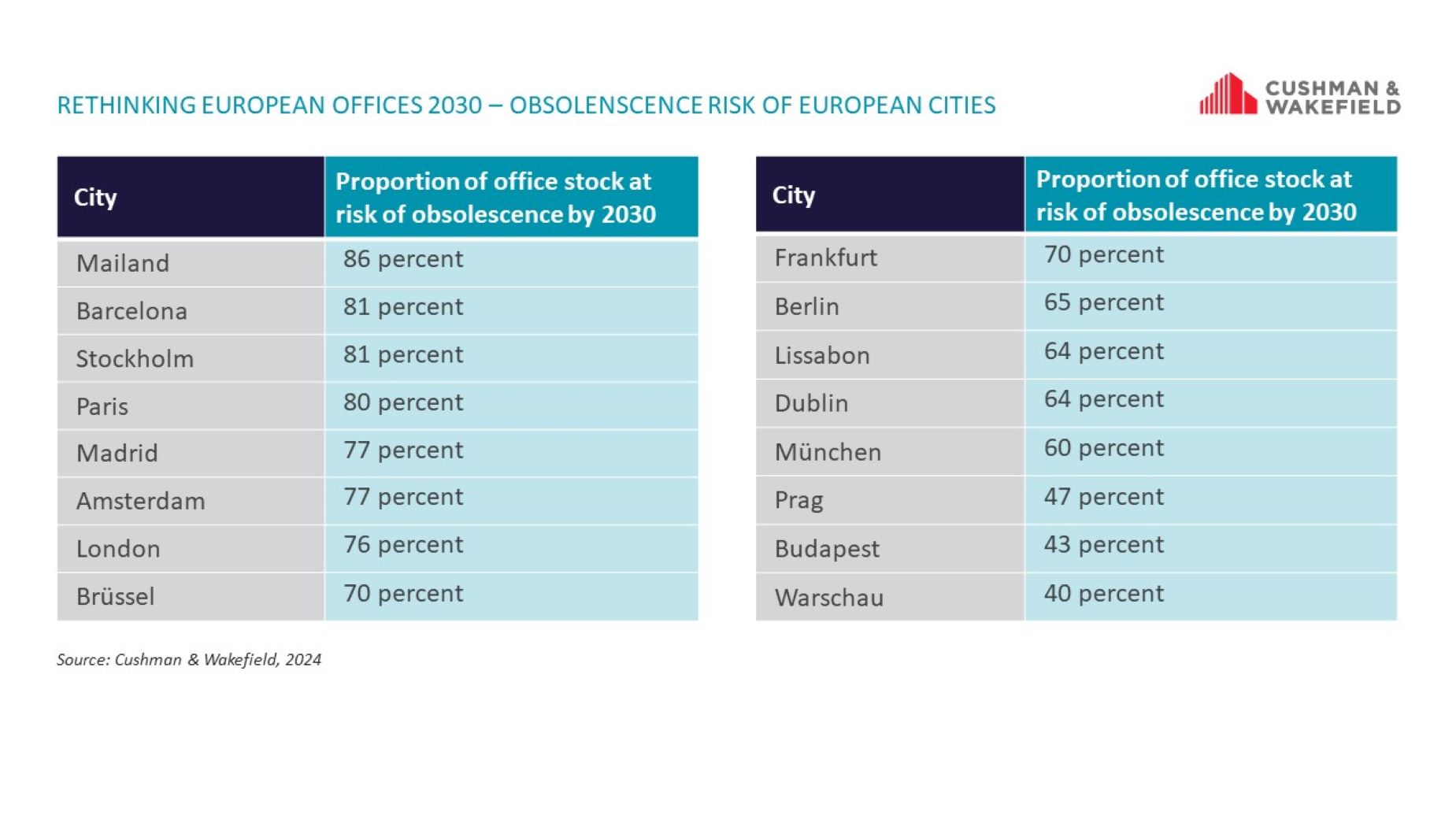

Two thirds of offices in the top 3 German office markets are threatened by obsolescence

Western European markets that have an older real estate stock overall, have an increased risk of obsolete office space. Leading the list is Milan, where approximately 86% of office properties are at risk of obsolescence. Germany, due to regular investments and refurbishments, offers a more stable starting position. In Berlin 65%, in Frankfurt 70% and in Munich 60% of the office stock is at risk. Nevertheless, there remains significant potential for optimisation even in these cities.

The flight-to-quality trend is clearly evident in Germany. In the five largest office markets (Berlin, Düsseldorf, Frankfurt, Hamburg and Munich), vacancy rates have risen by an average of 4.1% over the past five years. By the end of 2027, an additional 1.7% of office space is expected to become vacant. According to a recent analysis of newly signed leases by C&W, tenants have reduced the size of their newly rented spaces by an average of 19% compared to previous locations. While overall demand for office space is declining, users are seeking smaller but modern spaces that meet ESG standards.

Not investing can be expensive.

Investments are unavoidable if offices are to continue to be let profitably. In central locations with high demand for high-quality space, it usually makes sense to reposition and upgrade existing properties (repositioning). The solution includes measures such as improving energy efficiency, integrating modern technologies and redesigning interiors to meet the requirements of modern working environments.

In decentralized locations, refurbishment of office space is usually uneconomical due to lower demand. Instead, repurposing into alternative uses - such as residential or mixed-use buildings - can be a viable option.

Do you have questions about obsolescence? Or do you need support to make your office properties fit for the future? We will be happy to advise you - individually, economically and sustainably. And always with your budget in mind. Please feel free to contact me.

A significant proportion of German office stock is threatened by structural vacancy. Investments are unavoidable if properties are to be let economically and sustainably. The crucial question isn't the cost of investment, but the cost of inaction.

Lutz Schilbach, Head of Multi Service Solutions DACH