EUROPEAN HOTEL MARKETBEAT H1 2024

European Hotel Deal Volumes Surge To Five-Year High.

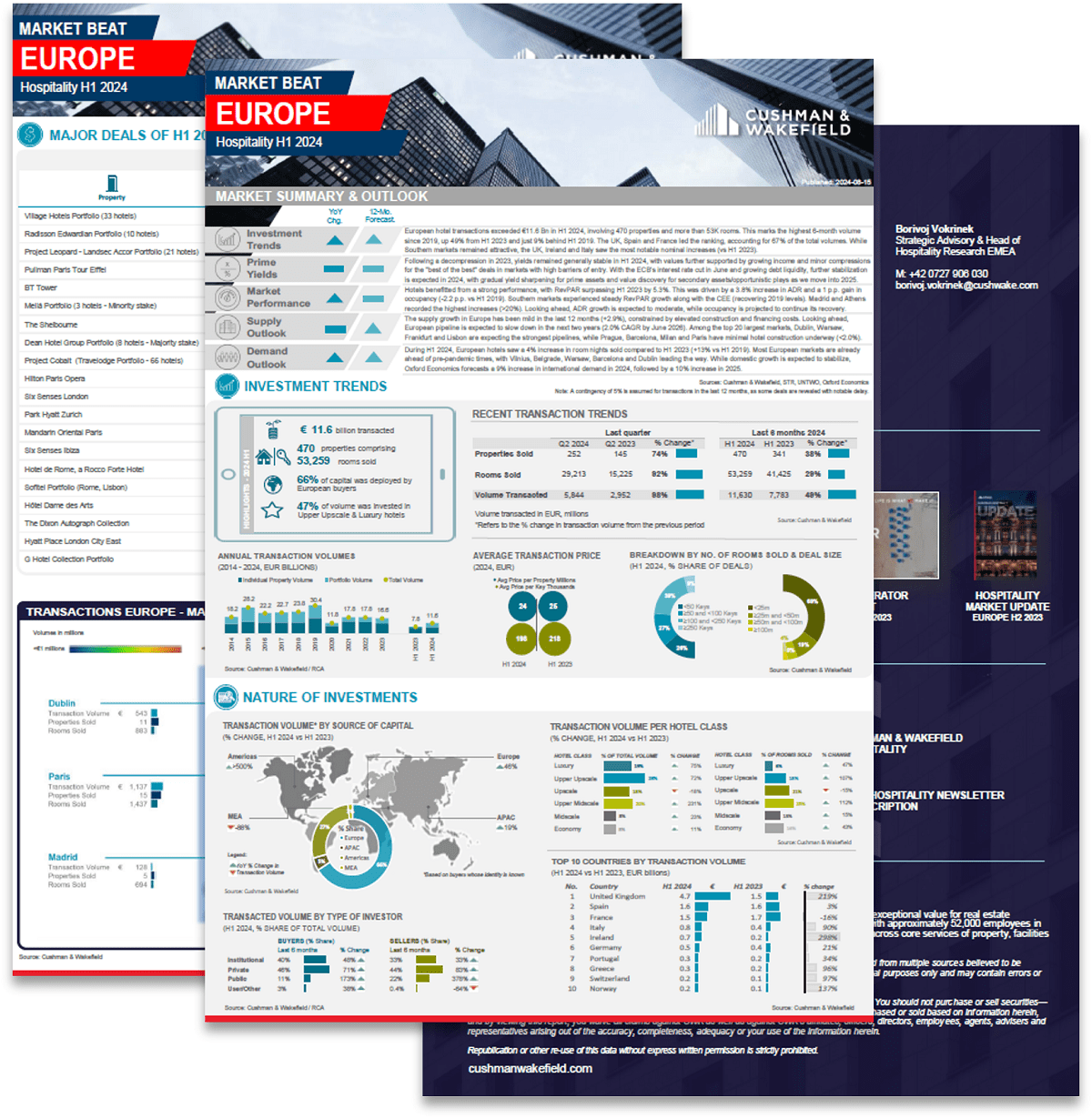

European hotel transactions reached a five-year high in the first half of 2024, according to our latest data. Transactions in the first half of the year grew to over €11.6 billion, the highest six-month volume since 2019.

In the second quarter, European hotel transaction volumes hit €5.8 billion, nearly double the level reached at the same time last year (€3.0 billion in Q2 2023). Volumes were boosted by several landmark hotel transactions, including the sales of the Pullman Paris Tour Eiffel, the Hilton Paris Opera, Six Senses London, the Shelbourne Hotel Dublin, and the Park Hyatt Zürich. Overall, luxury hotels represented nearly half of H1 2024 volumes.

The UK, Spain and France were the most active markets, accounting for €7.8 billion of transactions – over two thirds of the European total, and 62% more than H1 2023. London registered the highest volume of transactions by city, with Paris, Dublin, Barcelona and Rome completing the top five. Looking ahead, volumes are projected to exceed €20 billion in 2024, driven by increasing debt liquidity and strong hotel performance.

Learn more by downloading the report.

EUROPEAN HOTEL MARKETBEAT 2023

Final Quarter Boosts European Hotel Deal Volumes.

A strong final quarter saw European hotel transactions reach nearly EUR 17 billion last year, according to new data from Cushman & Wakefield.

Across the year, 787 properties were sold comprising 106,000 rooms and totalling EUR 16.9 billion in value. This remains significantly below 2019 levels but is only 4% short of the 2022 total. In the last quarter, volumes reached EUR 5.4 billion, a 13% increase relative to Q4 2022 (EUR 4.8 billion).

Several major individual deals drove these volumes, including the sale of the Westin Paris Vendome, the Center Parcs Allgäu in Germany, the Six Senses Hotel Rome, the Mandarin Oriental and Hotel Sofia in Barcelona, and Haymarket House in London (office to hotel conversion).

According to the research, portfolio transactions represented one third of the 2023 total volume (vs. 28% in 2022 and 45% in 2019). Most of these portfolio transactions were completed in the last quarter of 2023, representing more than half of the volumes transacted (56% in Q4 2023, vs 31% in 2022 and 35% in 2019).

Spain, France, and the UK were the most active markets, accounting for 59% of European volumes in 2023 with a total of EUR 10 billion (+7% vs 2022). Among the top-10 markets, Spain, France, and Greece witnessed the largest growth relative to 2022, with an increase of 44%, 26% and 23%, respectively. In terms of the key urban markets, London, Paris, and Madrid continue to be on the top of the list for investors followed by Barcelona and Rome.

Learn more about the initial findings by downloading the report.

MARKETBEAT – UK: Q3 2024

In Q3 2024, UK hotel real estate transactions reached approximately £732 million, marking a 93% increase compared to the same period in 2023. This surge, driven largely by single-asset deals in London (51% of the total in Q3), Edinburgh, and smaller regional sales, contrasts with the large-scale portfolio transactions that dominated the first half of the year. While full-year deal volumes are expected to surpass £5 billion, activity — excluding major portfolio trades — has been more nuanced, reflecting pricing challenges and a bid-ask spread. With the year-end approaching, market sentiment is shifting toward a more bullish outlook, supported by improving buyer-seller alignment, lower interest rates, and resilient hotel performance. Despite remaining uncertainties, optimism is rising as the ‘wait and see’ mentality fades.

For the full UK Market Beat, download the report.

OPERATOR BEAT – EUROPE 2023

Findings from the Cushman and Wakefield Operator Beat 2023 indicate that capital cities throughout Europe continue to hold their allure for operators, with the recent addition of Vienna to this esteemed list. Notably, City markets in France, Germany, Benelux, and Turkey have experienced a surge in operator interest since 2021.

The Operator Beat surveys were conducted among over 195 senior executives of leading hotel operators active in Europe. The surveys were carried out in H1 2023 across nine different markets: the Iberian Peninsula, UK & Ireland, France, Benelux, Italy, DACH, CEE, SEE, and Turkey.

Learn more about the initial findings by downloading the report.

THE HOTEL INVESTMENT SCENE IN CEE 2023

Welcome to our fourth edition of the joint Cushman & Wakefield–CMS report on the Hotel Investment scene in CEE*: Getting Real about ESG in Hotel Real Estate.

In recent years, the hotel sector in CEE has endured a very volatile period. Starting with the pandemic in 2020, followed by Russia’s unprovoked invasion of Ukraine in 2022, and consequent economic challenges underpinned by the energy crisis and sharp increase in overall inflation. Not surprisingly, this had a detrimental impact on hotel performance and investment activity across the region, as described in this report. However, the hospitality industry is resilient and able to rebound quickly. The recovery is already underway and has surpassed most expectations. Hotels across the CEE region are showing robust performance, already exceeding pre-pandemic levels in many markets.

*CEE-6 countries comprise the Czech Republic, Slovakia, Poland, Hungary, Romania and Bulgaria.

Learn more about the initial findings by downloading the report.

MARKET BEAT – Europe: H1 2022

Hotel transaction volume across Europe reached just over €7 billion during the first six months of 2022, with 319 properties changing hands. Despite the strong recovery of travel demand and the wall of capital looking for opportunities, transaction activity remained flat compared to the same period last year, with investor appetite constrained by rising financing and operating costs, fears over consumer confidence and a lack of willing sellers.

Read the full UK Market Beat for H1 2022 here.

For the full European Market Beat, download the report.

HOTEL OPERATORBEAT – UK & Ireland: H2 2021

We surveyed international and national hotel operators active in the UK & Ireland to determine their interest in the key hotel locations, when they expected the hotel market to recover and what the current transactional challenges are.

For the UK & Ireland hotel operator overview, download the findings

HOTEL INVESTORBEAT – Europe: H1 2022

The survey was conducted by Cushman & Wakefield during April and March 2022. It was completed by 56 respondents, including senior representatives of major private equity firms, funds, REITs and other institutional investors active in the European hotel real estate market. The respondents’ firms invested in aggregate over EUR 20 billion during the last five years (2017-2021), accounting for about a fifth of all hotel transaction volume in Europe. Download the findings.

.jpg?rev=83a8e457620f450190ef7b3912fa86e0)