Stories

METRO Japan | Asset Disposition Project related to a withdrawal from the Japanese market

01 background

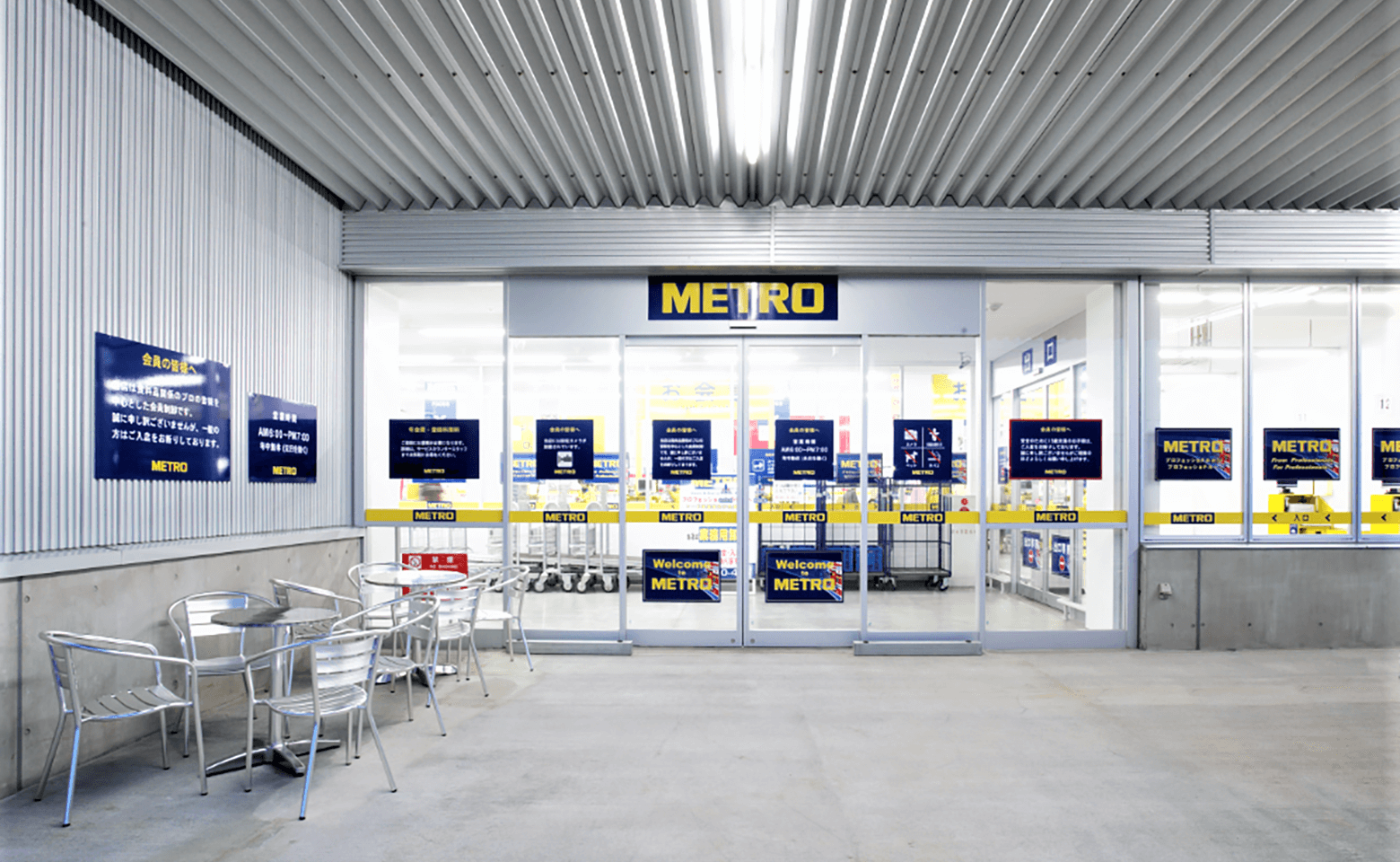

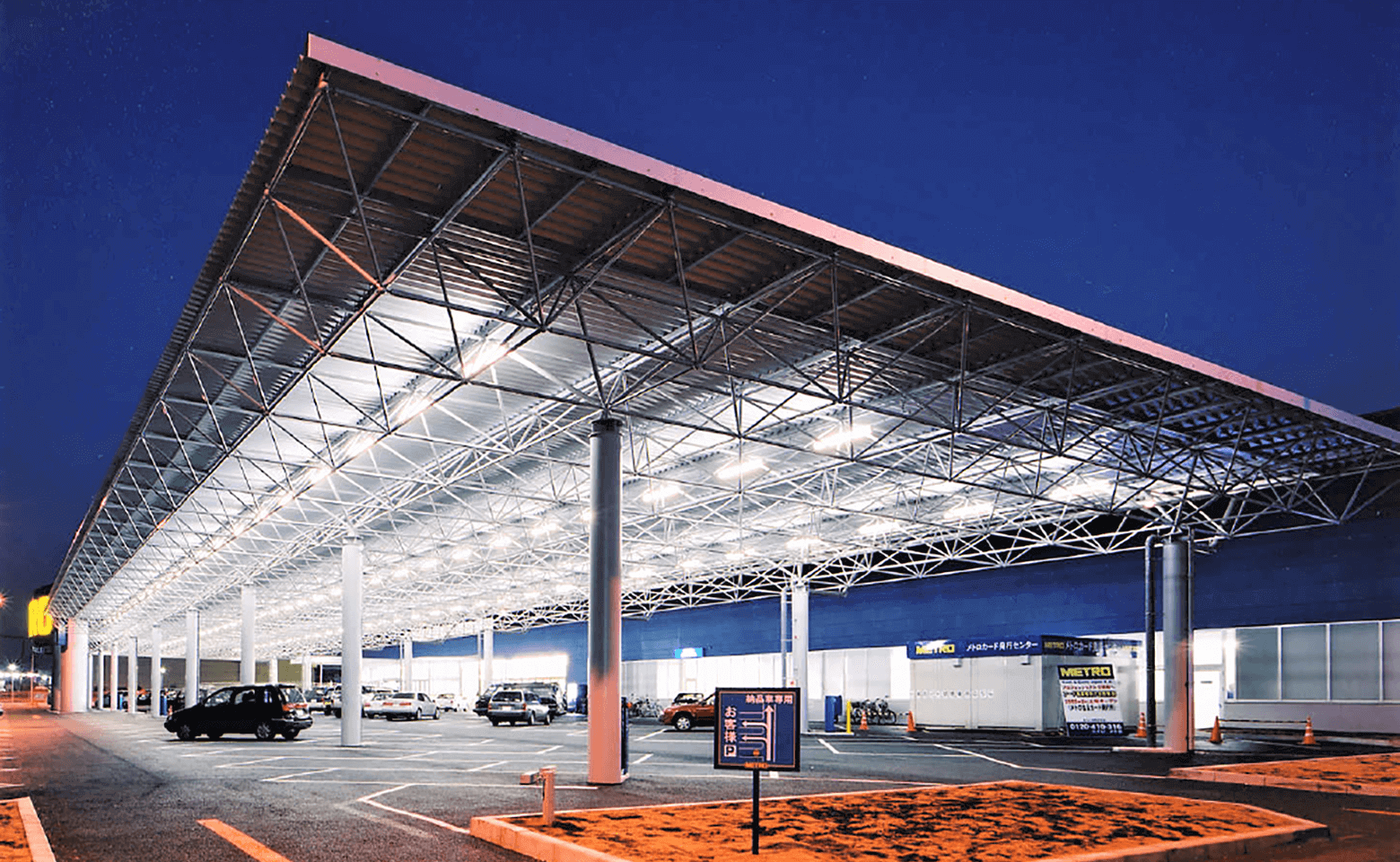

METRO AG, a company headquartered in Germany that operates wholesale markets for restaurants, hotels, other food and beverage businesses as well as individual traders internationally, decided to withdraw from the Japanese market in 2021. As part of the withdrawal process, its Japanese subsidiary, METRO PROPERTIES, the real estate subsidiary of its holding, acting on behalf of METRO Cash & Carry Japan K.K. sought proposals from real estate consultant to handle the sales transaction of its real estate facilities in Tokyo.

The locations of the nine properties, three of which were based on fixed-term land leases, are widely dispersed throughout the Tokyo metropolitan area.

Most of the proposals submitted to METRO PROPERTIES focused on speed of disposition, such as selling only the easy-to-sell properties (excluding the three leased properties); a sale of the portfolio as a whole to professional investors or to individual investors according to pre-defined asset classes for onward use.

Cushman & Wakefield's (C&W) proposal was selected based on its customized approach that preserved the client's best interests. Instead of selling the portfolio as a whole, we recommended that each property be dealt with individually, elaborating on new purposes for each asset, thus finding its future users and ultimately its buyers. While this approach was more work intense because each of the properties was distinct in terms of location and individual surroundings, marketing efforts needed to be individually tailored, allowing the client to match the best purpose and consequently the matching buyer to each property. In addition, C&W had long assisted METRO for their Japanese facilities, and as a result we were confident that we were in the best position to elaborate and convey the optimal qualities of the properties.

02 The Solution

C&W adopted a diverse approach for the sale of the nine properties by fully leveraging its wide network as a full-service real estate agent. Our Investment Sales department reached out to its strong investor base, and our Logistics department assessed the properties for potential use as logistics facilities and warehouses. In parallel, our Retail services department offered the properties to its broad base of retail clients, utilizing its network cultivated through its street-level and suburban store development business. Thus, more than 240 companies were approached, and 37 prospective buyers participated in the bidding process.

Given the large number of interested parties and the widely dispersed locations of the assets, which would require lengthy on-site inspections, we decided that a virtual inspection using Digital Twin technology would be more effective and time-efficient during the preliminary rounds of the sales process. By creating and sharing 3D virtual images of the properties, the interested parties could walk through and learn about the assets online. This technology platform with its virtual tours also helped to speed up the decision-making process for the potential buyers.

03 The Result

C&W’s highly experienced team with deep market expertise and extensive connections successfully completed the project in 10 months, significantly ahead of the projected 24-month sale period.

Of the nine properties, two were purchased by institutional investors for re-developments into logistics usage, with the remaining sold to buyers for their own distinguished retail and hybrid usages. In one example, the purchaser was an educational institute intending to transform the property into an art museum, as it was meaningful to the client that their facility would contribute to the art world. Total sales proceeds achieved were significantly above the expected price, which greatly exceeded the client’s expectations.

C&W is proud to have delivered a customized solution that fully exceeded the needs and price expectations of our client.

Testimonial

"Cushman & Wakefield Japan has offered us a comprehensive scope of services in selling our vacant properties. They have applied a user-centric approach for each of our assets and found their optimal new purposes, thus delivering maximum divestment amounts. Precise and transparent work and strict adherence to time schedules stood out in their collaboration."

Wolfgang Baumgartinger

Vice President Transactions, METRO PROPERTIES

Contact

WE’RE ON HAND TO HELP

Related Stories

Related Services

Asset Management

We provide fully licensed, full-service asset management including investment advisory (toshi jogen dairi gyo) and investment management (toshi unyo gyo), all delivered by experienced managers who have been active since the start of the property fund business in Japan in 2001.

Japan Desk

Our experts help Japanese companies set up footprints on a global scale. With solid knowledge of local business practices, the Japan Desk leads cross-border projects, supporting various Japanese companies' corporate real estate needs globally through market research, consulting, acquisition, disposition, leasing, and portfolio management.

Capital Markets

Are you ready to take your commercial property portfolio to the next level? Fuelled by ideas, expertise, and commitment, our global capital markets platform advises institutional and private owners of real estate on the execution of some of the most significant transactions across the globe.